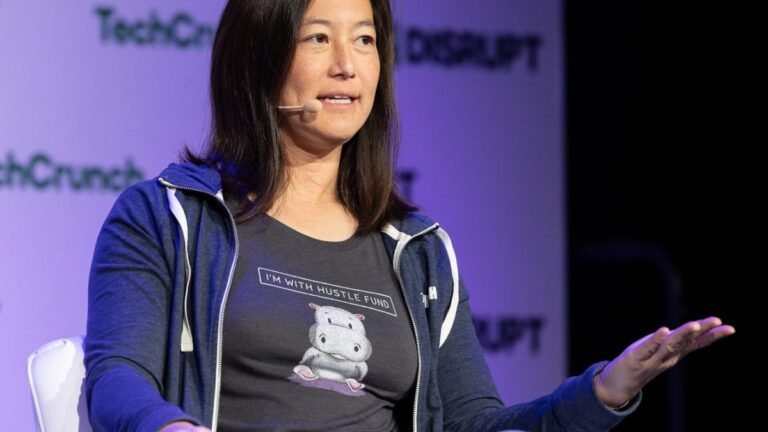

One of the key lessons learned from the dynamic venture funding landscape of Silicon Valley in recent years is that higher valuations do not always equate to better outcomes. Elizabeth Yin, co-founder of Hustle Fund, emphasized this point at TechCrunch Disrupt 2024, highlighting the potential negative impact of excessively high valuations on startups.

Valuation Strategy

Yin stressed the importance of setting realistic valuations that align with the startup’s growth trajectory. Overestimating the valuation early on can create challenges in subsequent funding rounds, as the business may struggle to meet inflated expectations. This can lead to issues such as employee stock devaluation, ultimately discouraging early team members.

Strategic Funding Approach

VC Renata Quintini of Renegade Partners emphasized the significance of structuring fundraising rounds strategically. By establishing clear valuation expectations and minimizing unnecessary delays in the funding process, startups can optimize their fundraising efforts. Quintini advised founders to gather input from VCs, evaluate market conditions, and carefully consider factors such as dilution and stake retention.

Negotiation and Due Diligence

In addition to financial considerations, founders should be prepared to negotiate terms beyond just valuation and funding amount. Board composition, voting rights, and other governance aspects can have a lasting impact on the startup’s trajectory. It is crucial to scrutinize term sheets for any nonstandard provisions that could impede future fundraising efforts.

By adopting a strategic approach to valuation and funding, startups can position themselves for sustainable growth and avoid potential pitfalls associated with overly ambitious valuations. Collaborating with experienced VCs and conducting thorough due diligence can help founders make informed decisions that pave the way for long-term success.