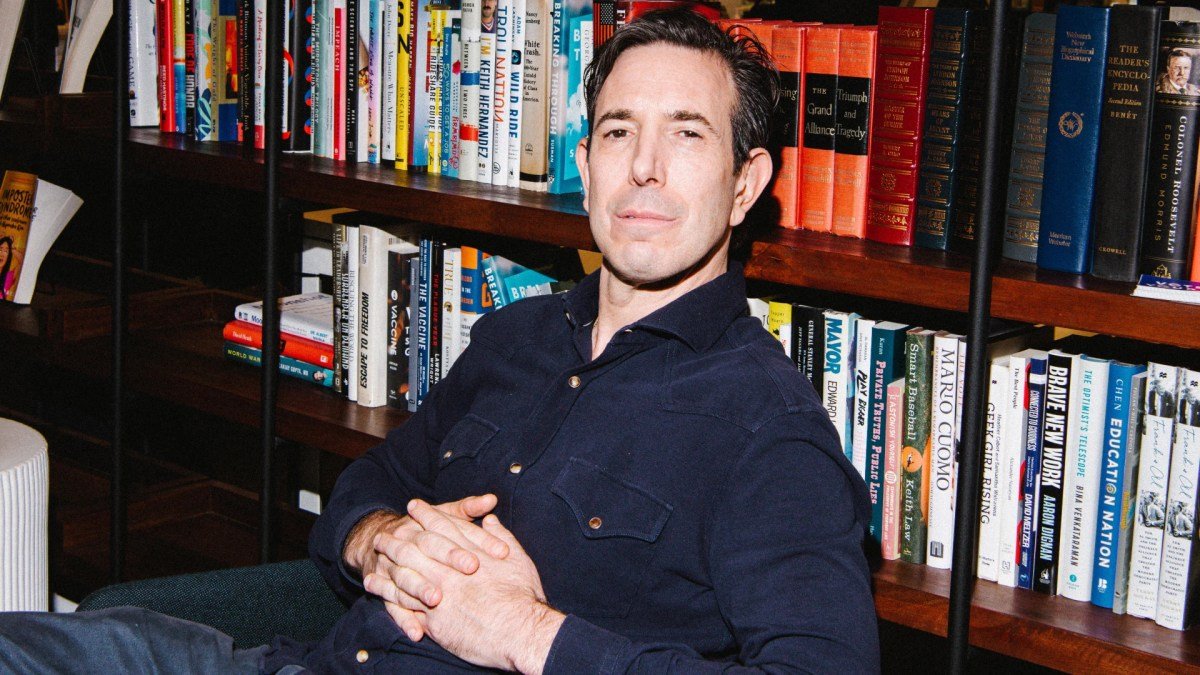

Bradley Tusk, co-founder of Tusk Venture Partners, shared with TechCrunch his perspective that the traditional VC model is no longer viable. Instead of raising a fourth fund, Tusk is embracing an “equity-for-services” approach, where he trades expertise for equity in startups.

Back to Basics

Tusk’s shift to equity-for-services harkens back to his early days when Uber paid him in equity for his political consulting services. This model allows him to focus on what he loves – helping startups navigate regulatory challenges.

Money Talks

Surprisingly, Tusk found that he actually made more money with equity-for-services compared to traditional venture investing. By keeping 100% of the proceeds, he bypasses the obligations of returning investment capital to investors and paying fees.

Tusk Venture Partners will continue supporting its current portfolio companies until 2031, showcasing a commitment to their success in this evolving landscape.