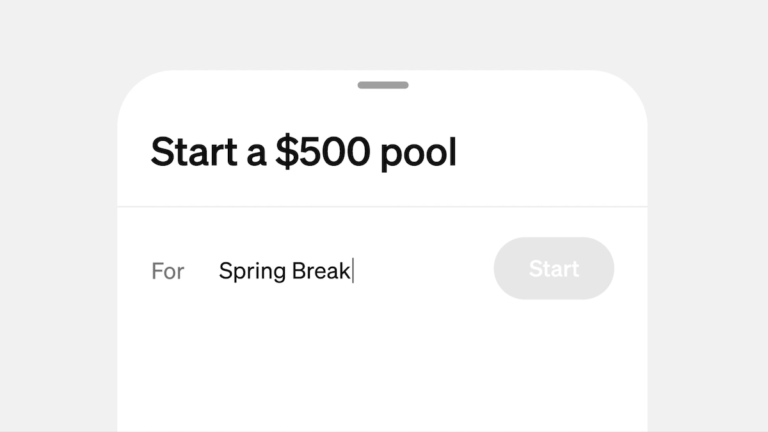

Cash App introduced a new feature on Tuesday called “pools” that enables users to combine funds with friends or family members for various expenses such as groceries, dining out, vacations, and group gifts. Initially accessible to a limited number of users, the feature is set to expand in the coming months.

Users can create pools by specifying a target amount and inviting contributors through their $cashtag or by sharing a link for non-users to contribute via Apple Pay or Google Pay. The organizer has the flexibility to close the pool at any time and transfer the funds to their Cash balance.

The inclusion of non-users in contributions through Apple Pay and Google Pay is a significant feature, as it aims to increase participation from individuals who are not currently using the app. This move is crucial for the platform’s growth, especially after facing lower-than-expected app usage, resulting in a first-quarter gross profit below projections.

Cash App’s introduction of the “pools” feature is part of its strategy to compete with rivals like Venmo and PayPal, both of which already offer similar money-pooling capabilities.