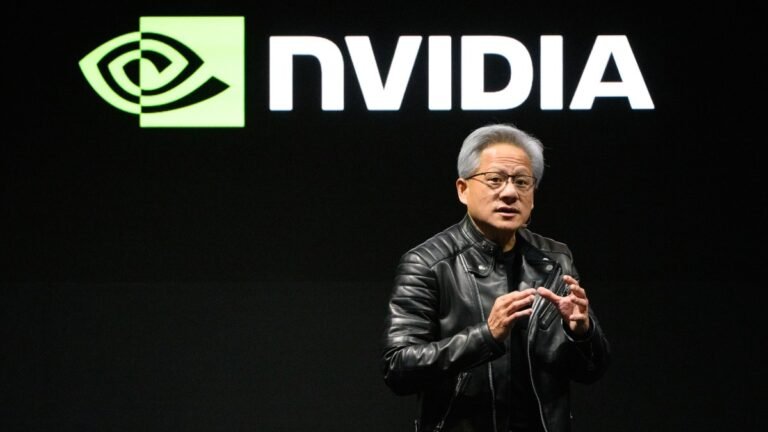

No company has capitalized on the AI revolution more dramatically than Nvidia. Its revenue, profitability, and cash reserves have skyrocketed since the introduction of ChatGPT over two years ago — and the many competitive generative AI services that have launched since. And its stock price soared.

During that period, the world’s leading high-performance GPU maker has used its ballooning fortunes to significantly increase investments in all sorts of startups but particularly in AI startups.

The chip giant ramped up its venture capital activity in 2024, participating in 49 funding rounds for AI companies, a sharp increase from 34 in 2023, according to PitchBook data. It’s a dramatic surge in investment compared to the previous four years combined, during which Nvidia funded only 38 AI deals. In 2025, Nvidia has already participated in seven rounds.

Nvidia has stated that the goal of its corporate investing is to expand the AI ecosystem by backing startups it considers to be “game changers and market makers.”

Below is a list of startups that raised rounds exceeding $100 million where Nvidia is a named participant since 2023, including new ones it has backed so far in 2025, organized from the highest amount to lowest raised in the round.

### The billion-dollar-round club

**OpenAI:** Nvidia backed the ChatGPT maker for the first time in October, reportedly writing a $100 million check toward a colossal $6.6 billion round that valued the company at $157 billion. The chipmaker’s investment was dwarfed by OpenAI’s other backers, notably Thrive, which according to the New York Times invested $1.3 billion.

### The many-hundreds-of-millions-of-dollars club

**Crusoe:** A startup building data centers reportedly to be leased to Oracle, Microsoft, and OpenAI raised $686 million in late November, according to an SEC filing. The investment was led by Founders Fund, and the long list of other investors included Nvidia.

**Figure AI:** In February 2024, AI robotics startup Figure raised a $675 million Series B from Nvidia, OpenAI Startup Fund, Microsoft, and others. The round valued the company at $2.6 billion.

**Mistral AI:** Nvidia invested in Mistral for the second time when the French-based large language model developer raised a $640 million Series B at a $6 billion valuation in June.

**Lambda:** AI cloud provider Lambda, which provides services for model training, raised a $480 million Series D at a reported $2.5 billion valuation in February. The round was co-led by SGW and Andra Capital Lambda, and joined by Nvidia, ARK Invest, and others. A significant part of Lambda’s business involves renting servers powered by Nvidia’s GPUs.

**Cohere:** In June, Nvidia invested in Cohere’s $500 million round, a large language model provider serving enterprises. The chipmaker first backed the Toronto-based startup in 2023.

**Perplexity:** Nvidia first invested in Perplexity in November of 2023 and has participated in every subsequent round of the AI search engine startup, including the $500 million round in December, which values the company at $9 billion, according to PitchBook data.

Poolside: In a recent announcement, the AI coding assistant startup Poolside revealed that it secured $500 million in funding led by Bain Capital Ventures, with participation from Nvidia. This funding round valued the AI startup at an impressive $3 billion.

CoreWeave: Another notable investment from Nvidia was in the AI cloud computing provider CoreWeave, which raised $221 million in April 2023. Since then, CoreWeave’s valuation has skyrocketed from $2 billion to $19 billion, leading the company to file for an IPO. CoreWeave offers customers the ability to rent Nvidia GPUs on an hourly basis.

Together AI: February saw Nvidia joining the $305 million Series B funding round of Together AI, a company that provides cloud-based infrastructure for building AI models. Co-led by Prosperity7 and General Catalyst, this round valued Together AI at $3.3 billion. This marked Nvidia’s first investment in the company in 2023.

Deals of over a $100 million: Several other significant investments by Nvidia include Ayar Labs, a company focused on optical interconnects for improved AI compute and power efficiency, which raised $155 million in December; Kore.ai, a startup developing enterprise-focused AI chatbots that secured $150 million in December; and Sandbox AQ, a startup specializing in large quantitative models for complex numerical analysis and statistical calculations, which received a $150 million investment in April. Other notable investments by Nvidia in startups like Hippocratic AI, Weka, Runway, Bright Machines, and Enfabrica demonstrate the company’s commitment to supporting innovative AI technologies.